Understanding Different Types of Insurance Policies

Understanding Different Types of Insurance Policies

Blog Article

When it comes to selecting the right insurance coverage, understanding the various options available is crucial. An effective way to ensure you're making an informed decision is through an insurance policy comparison. This process allows individuals to assess different policies, ensuring they find the best coverage for their specific needs and budget. By exploring the types of insurance available, key factors to consider, and how to use online tools for comparisons, you can navigate this landscape more confidently.

Understanding Different Types of Insurance Policies

Insurance policies come in various forms, each designed to meet different needs. Here are some of the most common types:

Health Insurance

Health insurance provides coverage for medical expenses, including hospital stays, doctor visits, and prescription medications. Policies can vary in terms of coverage limits, types of services included, and provider networks.

Auto Insurance

Auto insurance protects against financial loss in the event of an accident or theft. It typically includes liability coverage, collision coverage, and comprehensive coverage, each addressing different aspects of vehicle ownership.

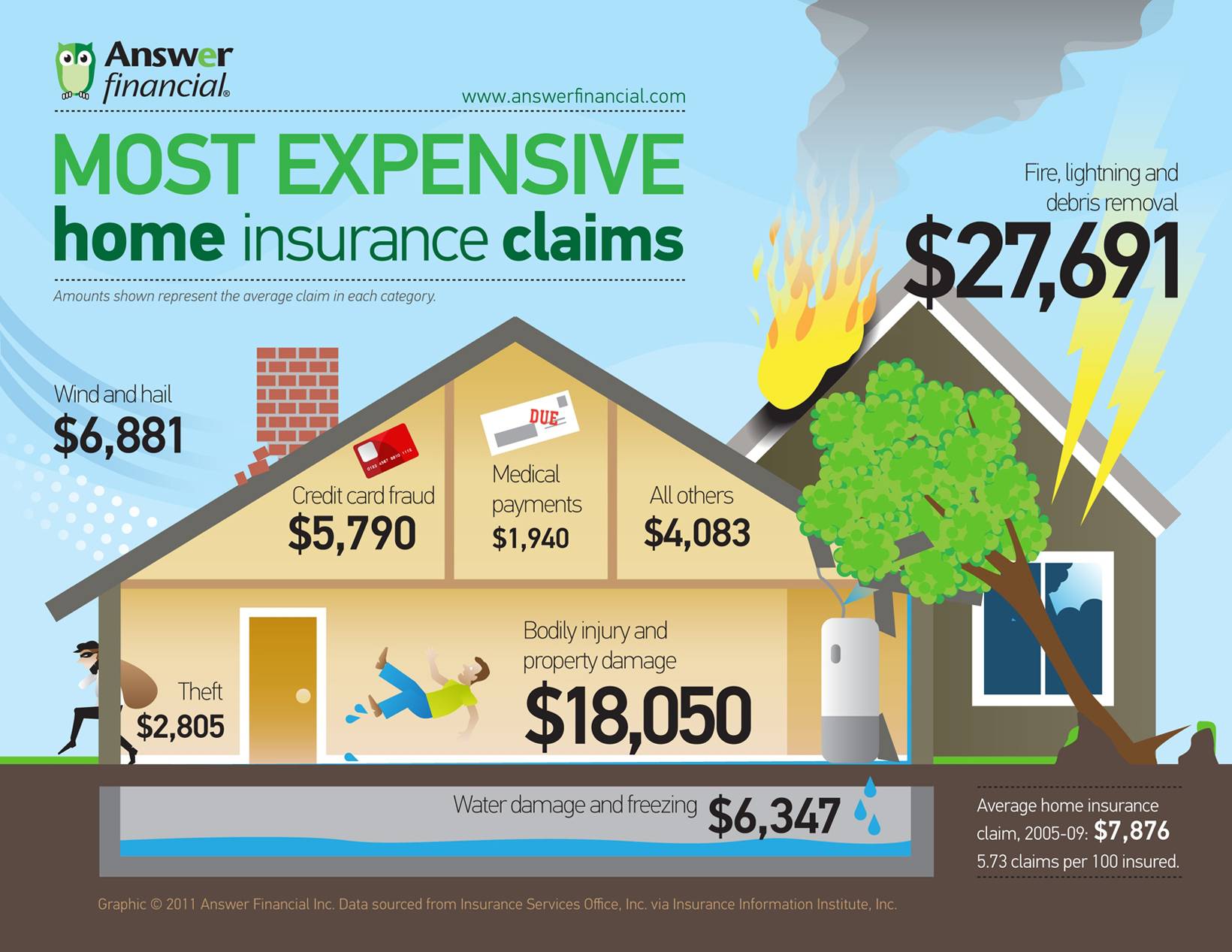

Homeowners Insurance

This insurance covers damage to your home and personal property due to various risks, such as fire or theft. Homeowners policies also often include liability protection in case someone gets injured on your property.

Life Insurance

Life insurance offers financial protection to your beneficiaries in the event of your death. There are different types, such as term life and whole life, each with unique features and benefits.

Liability Insurance

Liability insurance protects against claims resulting from injuries and damage to other people or property. This coverage is essential for businesses and individuals alike, helping to mitigate potential financial risks.

Key Factors to Consider When comparing insurance policies

When comparing insurance policies, several critical factors should guide your decision-making process:

Coverage Limits

Coverage limits refer to the maximum amount an insurance company will pay for a covered loss. It's essential to evaluate whether the limits sufficiently cover your needs, especially for high-value assets or significant health expenses.

Premiums

The premium is the amount you pay for your insurance coverage, typically billed monthly or annually. Understanding how premiums are calculated and the factors that influence them is vital for budget-conscious consumers.

Deductibles

A deductible is the amount you must pay out-of-pocket before your insurance kicks in. Policies with lower premiums often come with higher deductibles, so it's essential to balance these costs based on your financial situation.

Additional Benefits

Some policies offer additional benefits or riders that can enhance your coverage. These might include features like roadside assistance in auto insurance or replacement cost coverage in homeowners insurance. Consider which extras are valuable to you.

How to Use Online Tools for Insurance Policy Comparison

Online tools can significantly simplify the process of comparing insurance policies. Here are some practical steps to effectively use these resources:

Identify Your Needs

Before diving into comparisons, clarify what you're looking for in coverage. Make a list of your priorities, such as specific risks you want to cover or budget constraints.

Gather Information

Collect details about various policies from different providers. Online comparison tools can aggregate this information, making it easier to see how policies stack up against each other.

Utilize Comparison Websites

There are numerous websites dedicated to helping consumers compare insurance policies. These platforms allow you to filter results based on your criteria, streamlining the decision-making process. For a comprehensive insurance policy comparison, consider resources like OzK Insurance, which provides valuable insights and options tailored to your needs.

Read Reviews and Ratings

Consumer reviews and ratings can offer insights into the claims process and customer service experiences, which are critical factors when selecting an insurer.

Conclusion

In conclusion, conducting a thorough insurance policy comparison is essential for securing the best coverage for your needs. By understanding the different types of insurance policies, considering key factors such as coverage limits and premiums, and utilizing online tools effectively, you can make informed choices that provide peace of mind. Take the time to compare options, and you'll be better equipped to protect yourself and your assets.

Report this page